How To Create An Llc Florida

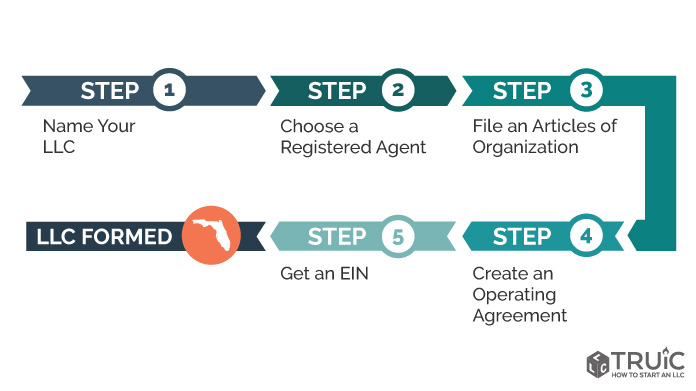

Forming an LLC in Florida is easy, just follow these simple steps:

To start an LLC in Florida, you'll need to file the Articles or Organization with the Florida Division of Corporations. The filing fee is $125. This can be done online at the the SunBiz website or by mail. The Articles of Organization is the document that officially creates your Florida limited liability company.

Follow the step-by-step guide below to form a Florida LLC today. You can learn more about LLCs and their benefits in our What is an LLC guide.

STEP 1: Name Your Florida LLC

Choosing a company name is the first and most important step in forming an LLC in Florida. Be sure to choose a name that complies with Florida naming laws, requirements, and is easily searchable by potential business clients.

1. Follow the naming guidelines for a Florida LLC:

- Your name must include the phrase "limited liability company," or one of its abbreviations (LLC or L.L.C.).

- Your name cannot include words that could confuse your LLC with a government agency (FBI, Treasury, State Department, etc.).

- Restricted words (e.g. Bank, Attorney, University) may require additional paperwork and a licensed individual, such as a doctor or lawyer, to be part of your Florida LLC.

2. Is the name available in Florida? Make sure the name you want isn't already taken by doing a name search on the Sunbiz Florida website.

3. Is the URL available? We recommend that you check online to see if your business name is available as a web domain. Even if you don't plan to create a business website today, you may want to buy the URL in order to prevent others from acquiring it.

Secure a Domain Name Instantly

After securing a domain name for your LLC, consider setting up a business phone service to establish further credibility and improve customer satisfaction. Nextiva offers a variety of helpful features such as unlimited voice and video callings, a convenient mobile app, and more. Try Nextiva today.

Not sure what to name your business? Check out our LLC Name Generator. After you get your business name, your next step is getting a unique logo. Get your unique logo using our Free Logo Generator.

FAQ: Naming a Florida LLC

What is an LLC?

LLC is short for Limited Liability Company. It is a simple business structure that offers more flexibility than a traditional corporation while providing many of the same benefits. Read "What is a Limited Liability Company?" for more information.

Watch our video: What is an LLC?

Do I need to get a DBA or Trade Name for my business?

Most LLCs do not need a DBA. The name of the LLC can serve as your company's brand name and you can accept checks and other payments under that name as well. However, you may wish to register a DBA if you would like to conduct business under another name.

To Learn more about DBAs in your state, read our How to File a DBA in Florida guide.

STEP 2: Choose a Registered Agent in Florida

You are required to appoint a Florida Registered Agent for your Florida LLC.

What is a Registered Agent? A registered agent is an individual or business entity responsible for receiving important tax forms, legal documents, notice of lawsuits, and official government correspondence on behalf of your business. Think of your registered agent as your business' point of contact with the state.

Who can be a Registered Agent? A registered agent must be a full-time resident of Florida or a corporation, such as a registered agent service, authorized to conduct business in the state of Florida. You may elect an individual within the company including yourself.

To learn more about Florida Registered Agents, read our full guide.

Recommended: ZenBusiness provides the first year of registered agent service free with LLC formation ($39 + State Fees)

FAQ: Nominating a Registered Agent

Can I be my own Registered Agent?

Yes. You or anyone else in your company can serve as the registered agent for your LLC. Read about being your own registered agent.

Is a Registered Agent service worth it?

Using a professional Registered Agent service is an affordable way to manage government filings for your LLC. For most businesses, the advantages (e.g. privacy, peace of mind, and preventing lawsuits) of using a professional registered agent service significantly outweigh the annual costs.

For more information, read our article on Florida registered agents.

STEP 3: File Your Florida LLC Articles of Organization

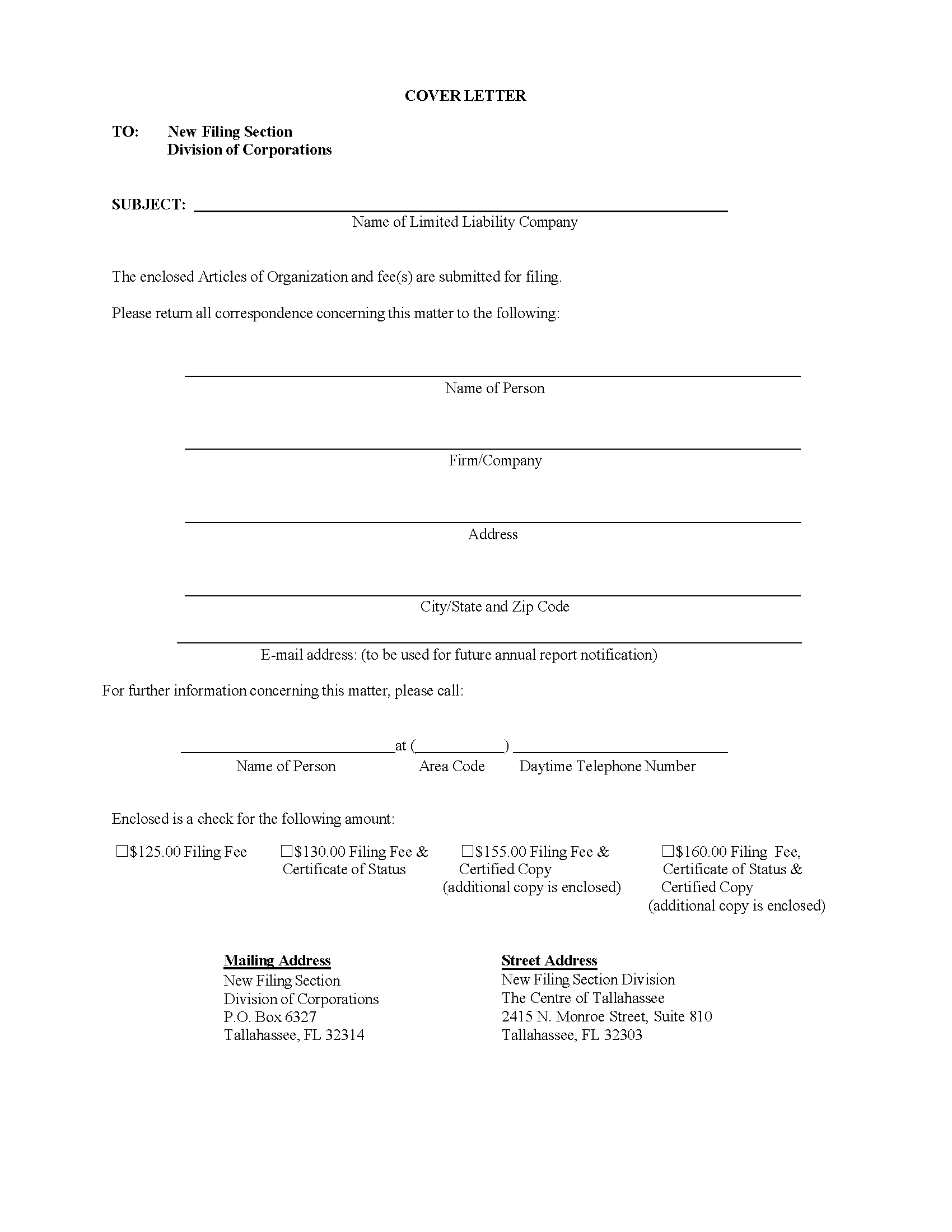

To register your Florida LLC, you'll need to file Form LLC-1 - Articles of Organization with the Florida Division of Corporations. You can apply online or by mail.

Now is a good time to determine whether your LLC will be member-managed vs. manager-managed.

OPTION 1: File Online through the Florida Department of State Sunbiz Website

File Online

- OR -

OPTION 2: File by Mail

Download Form

State Filing Cost: $125, payable to the Florida Department of State. (Nonrefundable)

Mail to:

New Filing Section

Division of Corporations

P.O. Box 6327

Tallahassee, FL 32314

For help with completing the form, visit our Florida Articles of Organization guide.

If you're expanding your existing LLC to the state of Florida, you'll need to register as a Foreign LLC.

FAQ: Filing Florida LLC Documents

How long does it take to form an LLC in Florida?

Florida LLC Articles of Organization are processed in the order they are recieved, and can take up from 2 to 4 weeks.

What is the difference between a domestic Florida LLC and foreign LLC?

An LLC is referred to as a "domestic LLC" when it conducts business in the state where it was formed. Normally when we refer to an LLC we are actually referring to a domestic LLC. A foreign LLC must be formed when an existing LLC wishes to expand its business to another state. If you are filing as a foreign Florida LLC read our guide for more information.

STEP 4: Create a Florida LLC Operating Agreement

An operating agreement is not required for an LLC in Florida, but it's a good practice to have one.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our Florida LLC operating agreement guide.

FAQ: Creating a Florida LLC Operating Agreement

Do I need to file my operating agreement with the State of Florida?

No. The operating agreement is an internal document that you should keep on file for future reference.

STEP 5: Get an EIN for your Florida LLC

What is an EIN? The Employer Identification Number (EIN), Federal Employer Identification Number (FEIN), or Federal Tax Identification Number (FTIN), is a nine-digit number issued by the Internal Revenue System (IRS); an Employer ID Number is used to identify a business entity and keep track of a business's tax reporting. It is essentially a social security number (SSN) for the company.. It is essentially a Social Security number for the company.

Why do I need an EIN? An EIN number is required for the following:

- To open a business business bank account for the company

- For Federal and State tax purposes

- To hire employees for the company

Where do I get an EIN? An EIN is obtained from the IRS (free of charge) by the business owner after forming the company. This can be done online or by mail.

FOR INTERNATIONAL APPLICANTS: You do not need an SSN to obtain an EIN. Read our guide to getting an EIN for international entrepreneurs.

Get an EIN

Option 1: Request an EIN from the IRS

Apply Online

- OR -

Option 2: Apply for an EIN by Mail or Fax

Download Form

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax:

(855) 641-6935

Fee: Free

FAQ: Getting an EIN

How do I get an EIN if I don't have a Social Security number?

An SSN is not required to get an EIN. You can simply fill out IRS Form SS-4 and leave section 7b blank. Then call the IRS at 267-941-1099 to complete your application. Read our guide for international EIN applicants.

What tax structure should I choose for my LLC?

When you get an EIN, you will be informed of the different tax classification options that are available. Most LLCs elect the default tax status.

However, some LLCs can reduce their federal tax obligation by choosing S corporation status. We recommend consulting with a local accountant to find out which option is best for you.

Do I need an EIN for my LLC?

All LLCs with employees, or any LLC with more than one member, must have an EIN. This is required by the IRS.

Learn why we recommend always getting an EIN and how to get one for free in our Do I Need an EIN for an LLC guide.

Have a question? Leave a Comment!

Ask us a question, tell us how we're doing, or share your experiences. Join the conversation in our Comment Section.

Have a question? Leave a Comment!

Ask us a question, tell us how we're doing, or share your experiences. Join the conversation in our Comment Section.

Considering Using an LLC Formation Service?

We reviewed and ranked the top 5 LLC formation services. Find out which is best for you.

Best LLC Services

Important Steps After Forming an LLC

Separate Your Personal & Business Assets

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your Florida LLC is sued. In business law, this is referred to as piercing the corporate veil.

You can start protecting your LLC in Florida with these steps:

1. Opening a business bank account:

- Separates your personal assets from your company's assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

Need help finding your EIN for your bank application? Visit our EIN Lookup guide for help.

Recommended: Read our Best Banks for Small Business review to find the best national bank, credit union, business-loan friendly banks, one with many brick-and-mortar locations, and more.

2. Getting a business credit card:

- Helps you separate personal and business expenses.

- Builds your company's credit history, which can be useful to raise capital (e.g., small business loans) later on.

For other important steps to protect your corporate veil, like properly signing legal documents and documenting company business, please read our corporate veil article.

3. Hiring a business accountant:

- Prevents your business from overpaying on taxes while helping you avoid penalties, fines, and other costly tax errors.

- Makes bookkeeping and payroll easier, leaving you with more time to focus on your growing business.

- Manages your business funding more effectively, discovering areas of unforeseen loss or extra profit

For more business accounting tools, read our guide to the best business accounting software.

Get Business Insurance for Your LLC

Business insurance helps you manage risks and focus on growing your Florida LLC. The most common types of business insurance are:

- General Liability Insurance: A broad insurance policy that protects your business from lawsuits. Most small businesses get general liability insurance.

- Professional Liability Insurance: A business insurance for professional service providers (consultants, accountants, etc.) that covers claims of malpractice and other business errors.

- Workers' Compensation Insurance: A type of insurance that provides coverage for employees' job-related illnesses, injuries, or deaths.

Find out how much it will cost to keep your business protected.

Get a Free Quote

Read our review of the best small business insurance companies.

Create Your Website

Creating a website is a big step in legitimizing your business. Every business needs a website. Even if you think that your business is too small or in an offline industry, if you don't have a website, you are missing out on a large percentage of potential customers and revenue.

Some may fear that creating a business website is out of their reach because they don't have any website-building experience. While this may have been a reasonable fear back in 2015, web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the main reasons why you shouldn't delay building your website:

- All legitimate businesses have websites - full stop. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own and control.

- Website builder tools like the GoDaddy Website Builder have made creating a basic website extremely simple. You don't need to hire a web developer or designer to create a website that you can be proud of.

Using our website building guides, the process will be simple and painless and shouldn't take you any longer than 2-3 hours to complete.

Send Out a Press Release

Press releases are among the easiest and best ways to promote your business. They are also one of the most cost-effective strategies as they:

- Provides publicity

- Establish your brand presence on the web

- Improve your website's search engine optimization (SEO), driving more customers to your website

- Are a one-time cost in terms of effort and money

- Have long-lasting benefits

Join the Conversation

We are here to guide you through your entrepreneurial journey, and are always looking at your feedback. Share your experiences in our comment box, chat with other entrepreneurs, or simply let us know how we're doing.

Let's Connect

Keep Your Company Compliant

Florida Business Permits & Licenses

Do I need business licenses and permits?

To operate your LLC you must comply with federal, state, and local government regulations. For example, restaurants likely need health permits, building permits, signage permits, etc.

The details of business licenses and permits vary from state to state. Make sure you read carefully. Don't be surprised if there are short classes required as well.

Fees for business licenses and permits will vary depending on what sort of license you are seeking to obtain.

Find out how to obtain necessary Florida busienss licenses and permits for your LLC or have a professional service do it for you:

- Federal: Use the U.S. Small Business Administration (SBA) guide to federal business licenses and permits.

- State: Check out the SBA's Florida Business Resource page to research which permits you will need for your LLC.

- Local: Contact your local county clerk and ask about local licenses and permits.

Recommended: If you are a first-time entrepreneur, consider having a professional service research your business's licensing requirements. Read our best business license services review on Startup Savant.

Florida LLC Tax Filing Requirements

Depending on the nature of your business, you may be required to register for one or more forms of state tax:

Sales Tax

If you are selling a physical product, you'll typically need to register for a seller's permit through the Florida Department of Revenue website.

This certificate allows a business to collect sales tax on taxable sales.

Sales tax, also called "Sales and Use Tax," is a tax levied by states, counties, and municipalities on business transactions involving the exchange of certain taxable goods or services.

Read our Florida sales tax guide to find out more.

Employer Taxes

If you have employees in Florida, you will need to register for Florida Re-employment Tax, a type of unemployment tax, through the Florida Department of Revenue. New employers pay an initial tax rate of .0270 (2.7%) on the first $7,000 of yearly wages paid to employees.

Industry Specific Taxes

If your business falls within a specific industry, additional state taxes may apply.

Federal LLC Tax Filing Requirements

Most LLCs will need to report their income to the IRS each year using:

- Form 1065 Partnership Return (most multi-member LLCs use this form)

- Form 1040 Schedule C (most single-member LLCs use this form)

How you pay yourself as an owner will also affect your federal taxes. Visit our guide to learn more about how to pay yourself from your LLC.

Read our LLC Tax Guide to learn more about federal income taxes for LLCs.

Florida LLC Annual Report

LLCs in Florida are required to file an annual report with the Florida Department of State. This can be done online.

File Online through Sunbiz Florida for your LLC

Apply Online

Fee: $138.75 (Nonrefundable)

Due Date: Florida's deadline for filing the annual report is May 1st of each year. Your LLCs first annual report is due the next calendar year after your llc was formed, so for an llc formed in 2019, its first annual report can be filed anytime between January 1st 2020 and May 1st 2020, then before May 1st each subsequent year.

Late Filings: Florida charges a $400 penalty if you miss the May 1st filing deadline. In addition, failure to file your annual report by the third week of September will cause your LLC to be dissolved.

Hiring Employees

If you plan to hire employees, stay compliant with the law by following these steps:

- Verify that new employees are able to work in the US

- Report employees as "new hires" to the State

- Provide workers' compensation insurance for employees

- Withhold employee taxes

- Print compliance posters and place them in visible areas of your work space

FAQ: Hiring Employees

What is the minimum wage in Florida?

The minimum wage in Florida is $10 per hour

How often do I need to pay employees?

Florida has no specified regulations on pay frequency. However Federal law states that you must have a consistent pay frequency. Typically most employers pay on a semi-monthly basis.

Avoid Automatic Dissolution

LLCs may face fines and even automatic dissolution when they miss one or more state filings. When this happens, LLC owners risk loss of limited liability protection. A quality registered agent service can help prevent this outcome by notifying you of upcoming filing deadlines, and even submitting reports on your behalf for an additional fee.

Recommended: ZenBusiness offers a reliable registered agent service and excellent customer support. Learn more by reading our ZenBusiness Review.

We understand that creating an LLC in Florida and getting your business up and running comes with many challenges. To help you succeed, we compiled the best local resources in every major metro area in Florida. You can get free assistance in the following areas:

Small Business Resources

Small Business Trends

Learn about the current US business trends so you can make the most informed business decisions.

Women in Business Tools and Resources

If you have a woman-owned business, many resources are available to help you concentrate on your business's growth:

- Funding - (ie. grants, investors, loans)

- Events - (ie. conferences, meetups)

- Guides - (ie. business formation, personal growth)

- Support - (ie. advice, communities, business strategies)

Our information and tools will provide educational sources, allow you to connect with other women entrepreneurs, and help you manage your business with ease.

Free LLC Legal Forms

TRUiC offers a number of free LLC legal forms to help with creating documents like:

- Operating agreements

- LLC resolutions

- Hiring documents, including:

- Employment contracts

- Independent contractor service agreements (ICSA)

- Non-disclosure agreements (NDA)

All you'll need to do to download the forms is sign up for the TRUiC Business Center, which is also free, forever.

How to Make a Website

Check out our how to build a website guide to learn how creating a website isn't as difficult as it might seem. With the right tools, a good guide, and a bit of patience, you can learn how to make a website for your business in no time.

Recommended: Read our review to find the best website builder to create your new small business website.

How to Build Business Credit

Learning how to build business credit can help you get credit cards and other business funding options in your business's name (instead of yours), with better interest rates, higher lines of credit, and more.

TRUiC's Small Business Tools

TRUiC believes business tools should be free and useful. Our tools help solve business challenges, from finding an idea for your business, to creating a business plan, writing an operating agreement for your LLC, and more.

Check out TRUiC's small business tools:

- Business Name Generator

- Business Idea Generator

- Free Logo Maker

- Operating Agreement Tool

- Business Plan Generator

- Entrepreneur Quiz

More Florida LLC Information

Florida Foreign LLCs

Forming a foreign LLC allows your company to operate as one entity in multiple states. If you have an existing LLC and want to do business in Florida, you will need to register as a foreign LLC. This can be done by mail.

File a Foreign LLC by Mail

Download Form

Fee: $125 (Nonrefundable)

Mail to:

Division of Corporations

Registration Section

P.O. Box 6327

Tallahassee, FL 32314

How to Obtain Certificate of Good Standing in Florida

A Certificate of Good Standing, known in Florida as a Certificate of Status, verifies that your Florida LLC was legally formed and has been properly maintained. Several instances where you might need to get one include:

- Seeking funding from banks or other lenders

- Forming your business as a foreign LLC in another state

- Obtaining or renewing specific business licenses or permits

You can order a Certificate of Status either online or by mail.

Request a Certificate Online through the Florida Department of State

Download Form

Fee:$5 (Nonrefundable)

How to Dissolve an LLC in Florida

If at any point in the future you no longer wish to conduct business with your LLC, it is important to officially dissolve it. Failure to do so in a timely fashion can result in tax liabilities and penalties, or even legal trouble. To dissolve your LLC, there are two broad steps:

- Close your business tax accounts

- File the Articles of Dissolution

When you are ready to dissolve your LLC, follow the steps in our Florida LLC Dissolution Guide.

Read More About LLCs and How to Run a Business

State of Florida Quick Links

Key Terms for Entrepreneurs

LLC: An LLC is a US business structure that offers the personal liability protection of a corporation with the pass-through taxation of a sole proprietorship or partnership.

DBA: A DBA, or doing business as name, is any name a business operates under that isn't its legal name.

Partnership: A partnership is an informal business structure owned by more than one individual that doesn't provide personal liability protection.

How To Create An Llc Florida

Source: https://howtostartanllc.com/florida-llc

Posted by: ramirezwharleas.blogspot.com

0 Response to "How To Create An Llc Florida"

Post a Comment